Does your community have any of the following common property components? Entrance signage or monuments? Fencing? Basins? Roadways or parking lots? Concrete sidewalks? If you answered yes to any of the above, chances are your community is not exempt from having a Reserve Study done.

But… what if you answered no? If your community is located in New Jersey and has less than $25,000 in common assets is a reserve study really necessary? Technically, any community with less than $25,000 in common capital assets is exempt from needing a Reserve Study. However, just because you don’t need something, doesn’t mean you shouldn’t want it. After all, wouldn’t you want to ensure your community’s future maintenance and replacements while also having an adequate financial plan?

The Reserve Study: A Community’s Best Financial Friend

A reserve study is a vital community tool for all communities – not just those in states where requirement legislation has passed. A reserve study identifies a community’s common assets and based on projected costs, recommends how much money should be put aside each year in a reserve fund. Associations maintain financial stability and avoid potential issues with insurance providers and lenders, when adequate reserves are maintained and ensured. Reserve studies are long-term funding plans that aim to better a community.

Adequate Funding: What Do You Mean? REALLY?

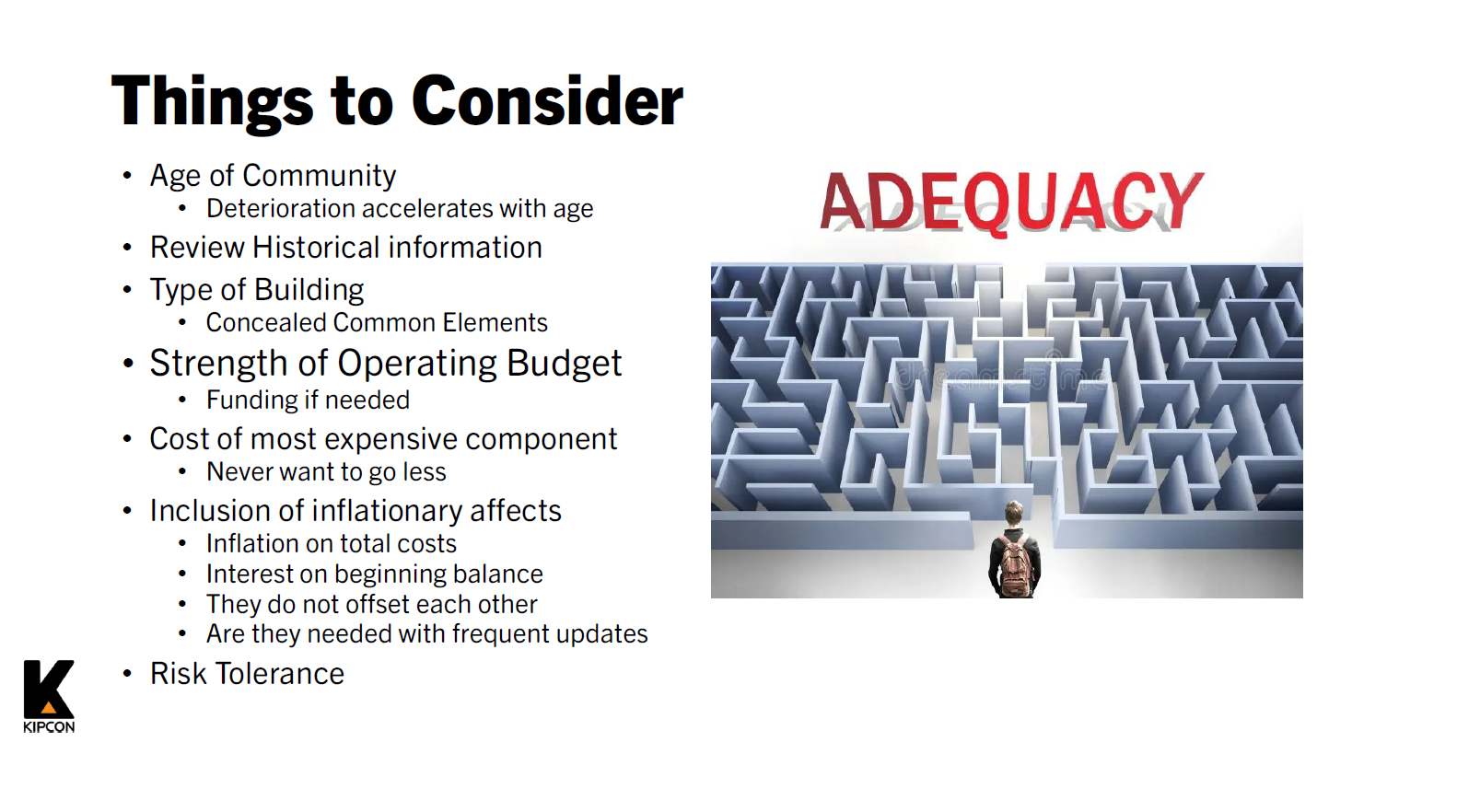

Adequacy means different things for different associations. A homeowner‘s association with single family dwellings and no amenities will have different funding needs than a twenty-five-story high-rise building.

Adequate reserves per the Community Associations Institute (CAI) National Standards refer to a replacement reserve fund and stable and equitable multiyear funding plan that together provide for the reliable and timely execution of the Association’s major repair and replacement projects without reliance on additional supplemental funding.

As defined in the New Jersey Legislation S2760, adequate and adequacy are defined as “sufficient so that the balance in the Association’s reserve fund will not fall below zero dollars as set forth in the Association’s 30-year funding plan.”

A community’s funding plan will depend on a number of factors. For example, how old is the community? A five-year-old community will have greater funding flexibility than a fifty-five-year-old community, which would certainly require more aggressive funding. A community’s reserve fund should also account for the most expensive common capital asset. Are there enough reserves to cover this component needing repairs or replacement?

Prioritizing Your Community’s Financial Future

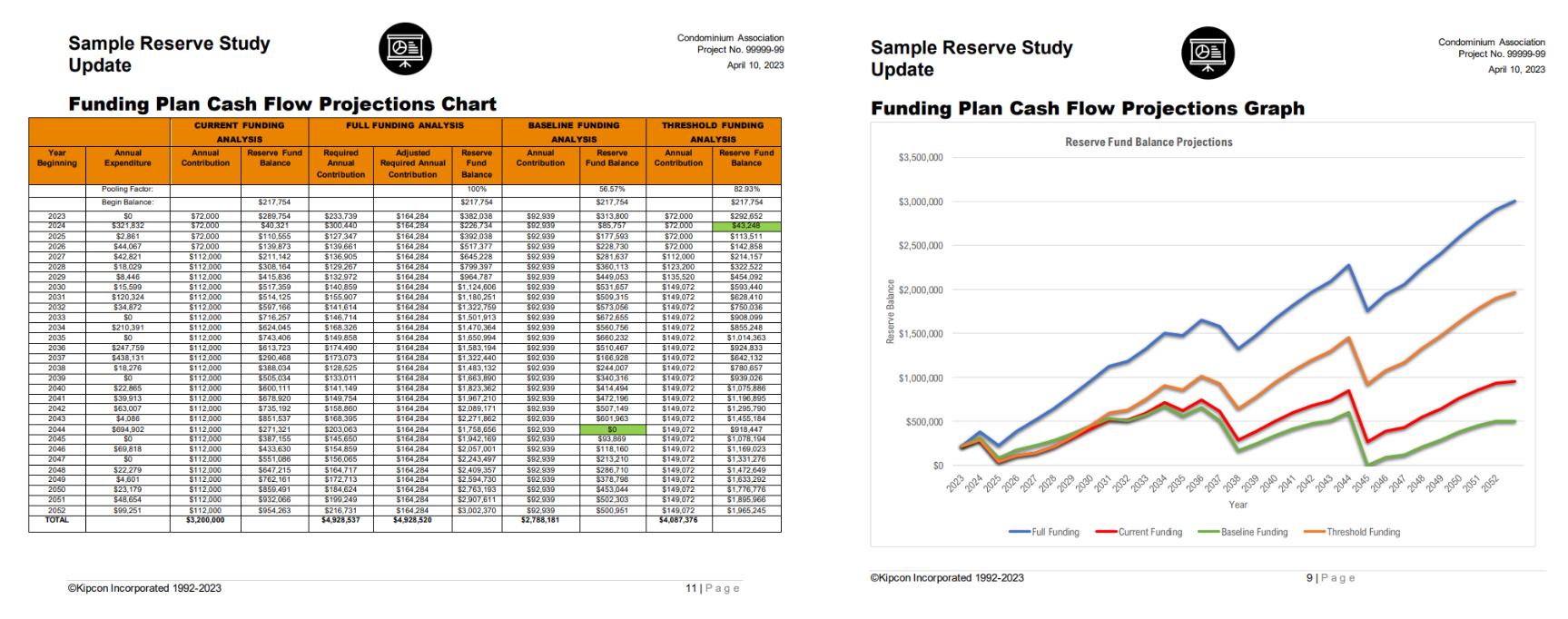

A reserve study will assist your community in determining the status of your reserve fund. Kipcon’s August 20, 2025 webinar, Choosing the Right Reserve Study & Adequacy, offers an in-depth look at the value of reserve studies, sharing key insights on adequacy based on real-world experiences with past clients. As explained in the webinar, the final reserve study report and funding plan provides a physical and financial analysis. The physical analysis lists the community’s common capital components (common component inventory) and evaluates the current conditions, remaining useful life expectancies (condition assessment), and provides estimates for repair and/or replacement of the components (cost estimates). The financial analysis assesses the current reserve fund balance and predicts the cash flow of the reserve fund over a 30-year period.

The best person to prepare the reserve study is a CAI certified Reserve Specialist (RS™). By partnering with one of Kipcon’s Reserve Specialists, associations gain a trusted expert and the ideal partner for ensuring long-term financial stability and effective planning.

Prepare For Your Next Reserve Study

Consulting with a professional who specializes in reserve studies is a vital part of effective and responsible planning.

Contact Kipcon today to request a proposal or to schedule your next reserve study with one of our Reserve Specialists and take the first step towards a secure and well-planned future for your community!

Call Kipcon at (800) 828-4118 or click here.